are dental implants tax deductible in 2019

Medical expenses are an itemized deduction on Schedule A and are deductible to the extent they exceed 10 of your adjusted gross income AGI. I paid 28k for the implants 5k as a down payment.

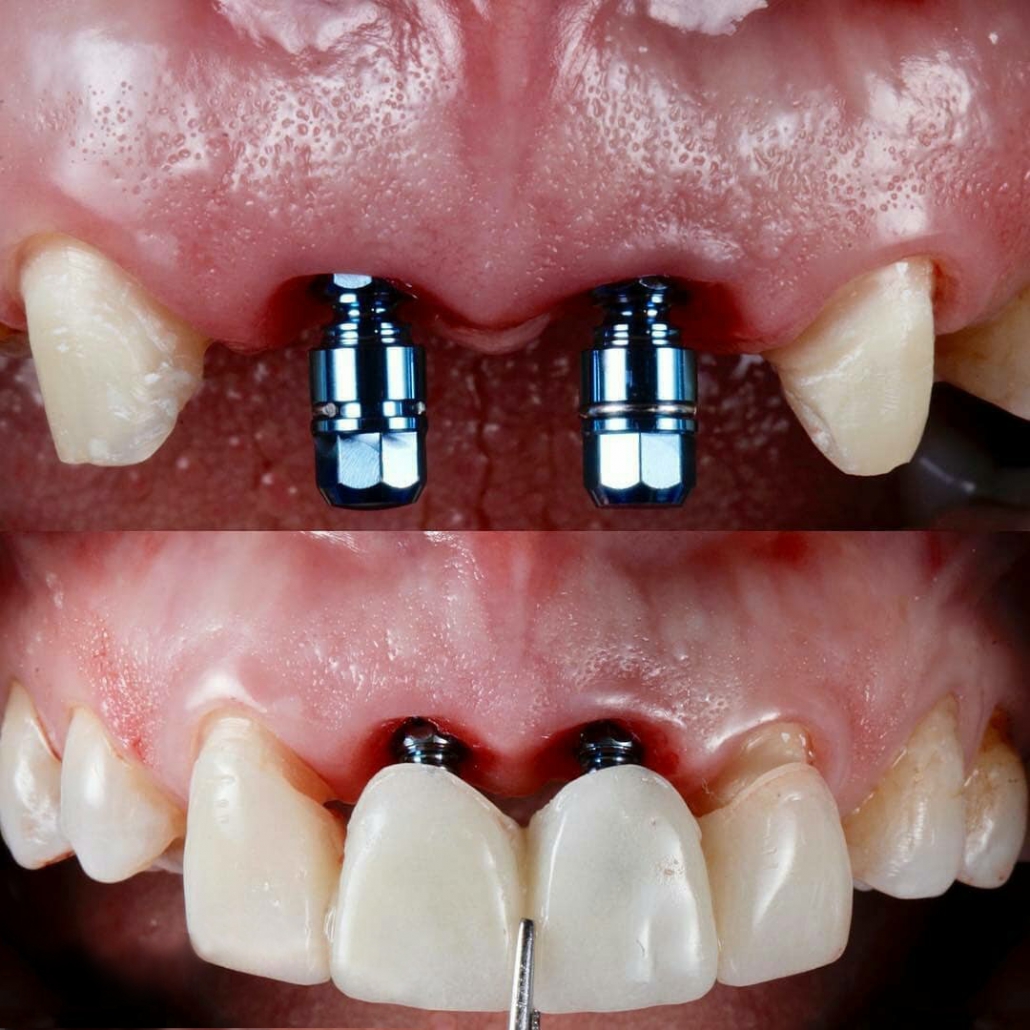

Dental Implants Cost In Palos Verdes And South Bay California

If you itemize your deductions.

. If youre wondering whether cosmetic surgery dental implants LASIK or other medical expenses are tax deductible the IRS has a document for you. 22 2022 Published 512 am. The refundable medical expense supplement is a refundable tax credit available to working individuals with low incomes and high medical expenses who meet the income requirement and all of the following conditions.

In addition the rule limiting the medical expense deduction for alternative minimum tax purposes to 10 of AGI doesnt apply to tax years beginning. The second factor involves your adjusted gross income. I am curious if I am able to deduct my dental implant.

Medical expenses in accordance with the amendments to the tax code that took effect on July 1 2019 are not deductible for taxable income for the 2020 tax year. I am curious if I am able to deduct my dental implant expense as a medical deduction. That means all types of operations dental work medications dental work benefits medical expenses and disability insurance premiums are no longer tax deductible.

If your treatment for implant or cosmetic dentistry is 50000 then 45125 is fully tax deductible. Of course your medical expenses plus your other itemized deductions still have to exceed your standard deduction before you will see a difference in your tax due or refund. Expenses related to OTC toothpaste dental floss mouthwash and general care products are typically not considered tax-deductible either.

If you are 65 or over they are deductible to the extent they exceed 75 Please click here. For this situation any dental treatment beyond 75 of AGI 4875 is fully tax-deductible. You made a claim for medical expenses on line 33200 of your tax return or for the disability supports deduction on line 21500.

Preventive treatment includes the services of a dental hygienist or dentist for such procedures as teeth cleaning the application of sealants and fluoride. 44321 satisfied customers. For instance if you had 3000 in dental expenses and made 20000 1500 of your expenses are deductible.

For tax years beginning after December 31 st 2016 and ending before January 1 st 2019 the 75 of adjusted gross income floor for medical expenses applied to ALL taxpayers. If you itemize your deductions you can deduct 5 of your adjusted gross income. This brings us back to the question Are porcelain crowns dental implants and fillings medically necessary.

The IRS states that you may deduct charitable contributions of money or property made to qualified organizations. Single 12200 1650 65 or older. May 31 2019 855 PM.

Keep in mind that there are perimeters around donating to the non-profit of your choice. Only the portion of your medical and dental expenses that exceed 7 can be deducted for the 2020 tax year. Generally you may deduct up to 60 percent of your gross income but 20 30 limitations apply in some cases.

You can include in medical expenses the amounts you pay for the prevention and alleviation of dental disease. A home equity loan for the full amount of treatment 50000. While dental implants arent specifically mentioned in IRS Publication 502 the IRS says.

If they were performed to repair damaged teeth and restore oral health the answer is most. To enter your medical expenses go to FederalDeductions and CreditsMedicalMedical Expenses. By taking this deduction on your tax return you receive a tax refund of roughly 11 281.

When you itemize the IRS allows you to deduct medical and dental expenses that exceed 75 percent of your adjusted gross income for tax year 2021. Yes dental implants are an approved medical expense that can be deducted on your return.

Are Dental Procedures Tax Deductible Spanaway Dental Wellness

Are Dental Implants Tax Deductible Drake Wallace Dentistry

/https%3A%2F%2Fd1l9wtg77iuzz5.cloudfront.net%2Fassets%2F4017%2F137059%2Fmax_width_extra_small_dental-implants.jpg%3F1454523493)

Dental Implant Cost Santa Fe Nm Taos Nm Los Alamos Nm Oral Surgery And Dental Implant Center Of Santa Fe

How Can United Medical Credit Help Me With Dental Implant Financing United Medical Credit

Dental Implant Cost Santa Fe Nm Taos Nm Los Alamos Nm Oral Surgery And Dental Implant Center Of Santa Fe

Implants Dental Insurance Premium Benefits Alternatives

3 Irs Dental Implant Discount Plans Tax Deductible Savings

The Cost And Considerations Of Dental Implants In Los Angeles California Dental Implants Cost

Are Dental Veneers And Implants Tax Deductible

Dental Implant Cost In Manhattan Advanced Dental Arts Nyc

All On 4 6 Full Arch Dental Implant Courses Itc Seminars

3 Irs Dental Implant Discount Plans Tax Deductible Savings

Dental Implant Cost In Gurgaon India 2022 Update Dantkriti Dental Clinic

The Cost And Considerations Of Dental Implants In Los Angeles California Dental Implants Cost

The Cost And Considerations Of Dental Implants In Los Angeles California Dental Implants Cost

Are Dental Implants Tax Deductible Atlanta Dental Implants

Is Cosmetic Surgery Tax Deductible These Procedures Can Be Claimed

/GettyImages-184878144-fad59359c24245ceb97dafe44c6d0e9e.jpg)